When there is a problem in updation of payroll of an organization, the QuickBooks Payroll Error PS033 arises . Because of this error mainly employees of the organisation are affected as the daily attendance will not be recorded and there will be problem in salary payment as here Payroll plays as a primary table where salary of employees is sub table. This problem mainly occurs due to CPS folder i.e. Critical Payroll Service Folder which acts as a directory folder for QuickBooks to connect with payroll service. Also the problem arises when there is a corrupt or damaged files. These files don’t let the QuickBooks user to access the payroll service, this it hinders the payroll processing.

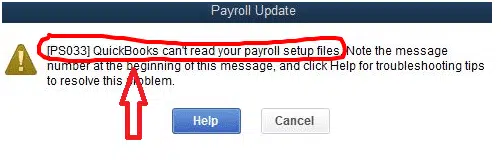

It comes with a warning message stating ‘ [PS033] QuickBooks can’t read your Payroll setup.’

Addressing this error promptly is important to make sure that there is accuracy and time efficient in payroll processing. In this article we will come through the causes, symptoms and troubleshooting of QuickBooks Payroll Update Error PS033.

Common Causes of QuickBooks Error PS033

QuickBooks Payroll Update Error PS033 occurs when the user is trying to download or install payroll updates. This error might appear out to be very frustrating as it restricts you from processing payrolls, thus leading to non-compliance issue and potentially dissatisfied employees. It lets break down the list of causes of Error PS033:-

- If CPS folder contains some damaged/corrupted files, the payroll setup will not be connected and user won’t be able to access the system.

- The outdated version of QuickBooks won’t get compatible with current version payroll setup thus, it shows up Error PS033.

- If you have invalid or no service keys then in that case user won’t be allowed to access the payroll system.

- You need to activate your payroll subscription otherwise can’t get their services. If not, QuickBooks Payroll Update Error PS033 is likely to happen.

- If the payroll service is expired or not valid, you will not be able to access the system.

- Error occurs when there is issue within the QuickBooks Company File.

You may also read: How to Fix QuickBooks Error 15276?

Symptoms of QuickBooks Error Code PS033

Symptoms of any error is a sign which tells that what is going to happen or the system is suffering. The QuickBooks Payroll Update Error PS033 is the problem related to the accessing of Payroll System setup due to various causes discussed above like damaged company file, invalid or inactive subscription, outdated version and corrupted files. Due to these causes there will be some effect on the system. Now let’s look up at some of the symptoms:

- Update failure: This is an inability to install or download payroll updates.

- Frozen screen: QuickBooks freezes or become unresponsive during the Error PS033.

- Delayed in Payroll: Due to this inefficiency, employees may not be able to receive payments on time which may lead to dissatisfaction and potential compliance issues.

- Error message- An explicit error message box with a warning appears on the screen.

- Payroll processing issues- There is difficulty in processing payroll due to interruption in updates.

Read also: How to Troubleshoot QuickBooks Banking Error 179?

Troubleshooting QuickBooks Payroll Update Error PS033

As we have identified the problem cause and symptoms which are hindering the performance of the system by QuickBooks Payroll Update Error PS033. We will with these effective troubleshooting steps, will ensure complete diagnosis and resolving of the problem from efficiency in businesses. Let take closer look at some steps:-

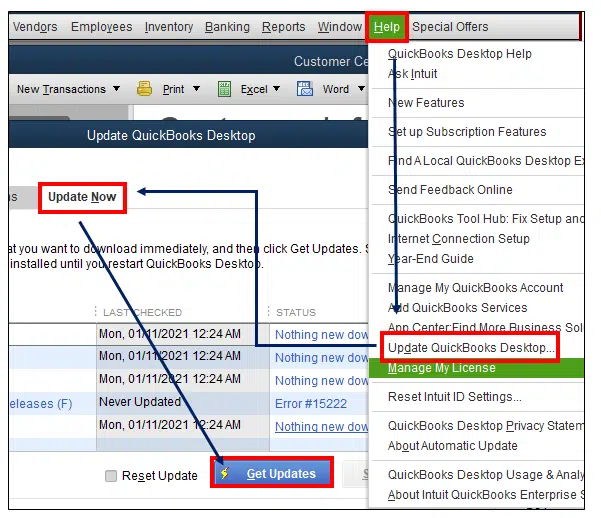

1: Updating QuickBooks to latest version

- First you need to open QuickBooks.

- Then go to help (displayed with PS033 error message) > Update QuickBooks.

- Next, click on update now and get updates.

- Once done with that, restart QuickBooks and try updating QuickBooks again.

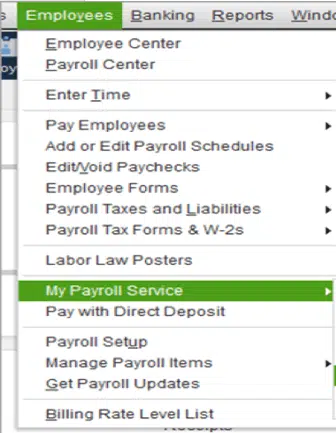

2: Verify and Update Payroll Subscription

- At very first step, open QuickBooks and then go to Employees > My payroll service > Account Billing Information.

- After that login to your Intuit account and if you take Payroll subscription or verify your subscription status.

- You need to make sure if subscription is active and up to date.

Check also: Resolving QuickBooks Online Error code 1000

3: Revalidate the Payroll Service key

- Firstly, open QuickBooks

- And then go to Employees> My payroll Service> and then Click on edit.

- Now re- enter the service key and click on next and then finish.

4: Repair the QuickBooks Installation

- First user need to open the control panel and navigate to Programs > Programs and features.

- At next step, select QuickBooks and Click on Uninstall/ Change.

- Now, select Repair option and follow the on-screen instructions.

- Towards the end, restart your computer when the repair process is completed.

Read this also: Fixing QuickBooks Error Code 108

5: Rename the CPS folder

- At first step, navigate to the folder ‘ C:\ Program files\ Intuit\ QuickBooks 20XX\ Components \ Payroll \ CPS.

- Next step, right click the CPS folder and then select rename.

- After that Add .old at end of the file name, for example, CPS.old.

- Once done with that, create a new folder named as CPS and try updating the software.

6: Checking and Repairing the Company File

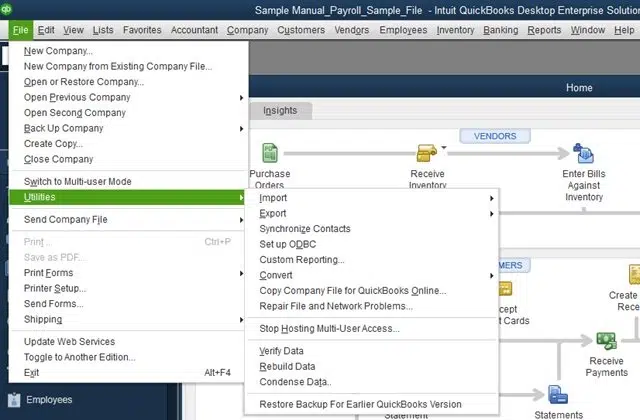

- First you need to open QuickBooks and go to Files > Utilities> Rebuild.

- Then go to File > Utilities and Rebuilt data to repair the company file.

- Then just follow onscreen instructions to complete the process.

Check this also: How to Resolve QuickBooks Online Error 350?

7: Download latest Payroll Tax Table

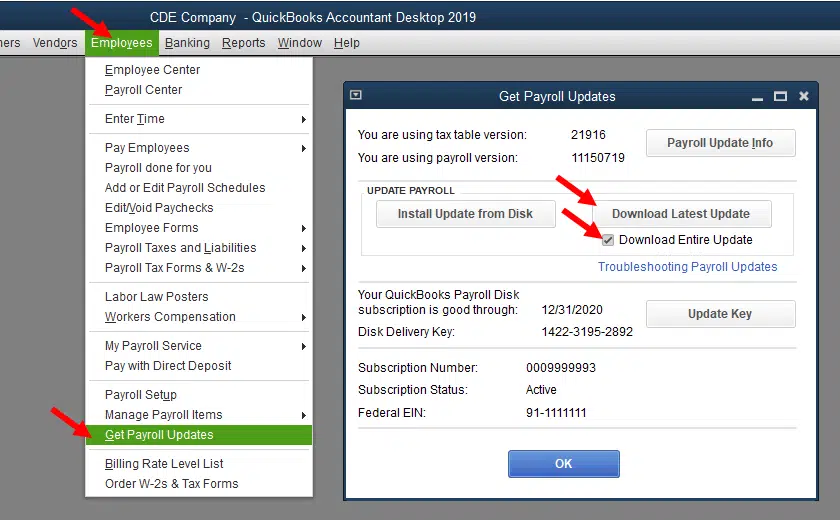

- The very first step is to open QuickBooks and go to Employees > Get payroll updates.

- Secondly, select Download Entire Update and next click on Update.

- Once the download is completed, restart QuickBooks and you need to check if the problem is still there or not.

Preventive Measures for avoiding Error PS033

We can take necessary steps to avoid QuickBooks Payroll Update Error PS033. By taking these steps we can avoid future encounter of error:-

- Regular Updating –Always check for regular update of the software to avoid the errors. Ensure that the QuickBooks are updated to the latest version available.

- Accurate information –Maintain the information in the system correctly and also keep an eye on Payroll subscription status.

- Routine file checking –Regularly check your company files and make sure they are accessible so that in future Error PS033 won’t occur. Repair and update the data regularly or periodically.

- Backup – Always backup your QuickBooks Data to prevent any data loss and ensure QuickBooks recovery in case of errors.

- Firewall and Antivirus settings –You should configure firewall and Antivirus settings which will allow QuickBooks to update without any interruption.

Conclusion!

QuickBooks Error PS033 can be an important hindrance to the Payroll system. It can effect the business management as there will be delay in remuneration of employees which may lead to dismay and inefficiency. But with the right steps and approach, troubleshooting steps can be implemented. The problem will be effectively resolved. If you continue to experience the payroll issues and seeking assistance from QuickBooks support or a professional support can provide additional guidance and solution. For more information about QuickBooks and H series errors contact us at +1-844-926-4607.